Renovate or Relocate? 3 Questions To Help You Decide

Does your current home no longer serve your needs? If so, you may be torn between relocating to a new home or renovating your existing one. This can be a difficult choice, and there’s a lot to consider—including potential costs, long-term financial implications, and quality of life. A major remo

National Real Estate Market Update for 2023

There’s an old adage in real estate: location, location, location. But ever since the Federal Reserve began its series of inflation-fighting interest rate hikes last year, a new mantra has emerged: mortgage rates, mortgage rates, mortgage rates. Higher rates had the immediate impact of dampening h

How to Become a Homeowner on a First-Time Buyer’s Budget

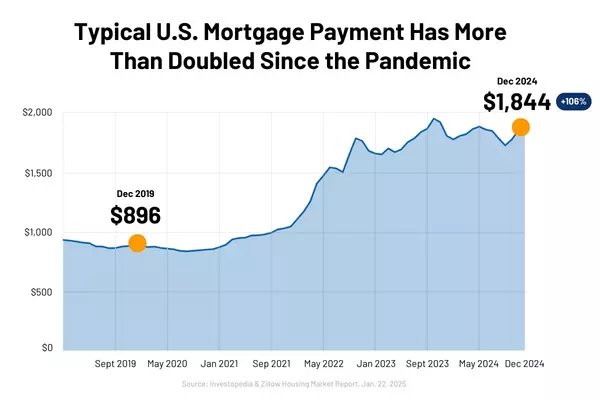

It's not easy being a first-time homebuyer right now. At the end of last year, housing affordability hit an all-time low.1 Additionally, mortgage rates have risen significantly since 2021, while inventory remains tight for many property categories, but especially for starter homes. Even lower-priced

Categories

Recent Posts